Employee Retention Credits – How can they help your business?

On December 27, 2020, the bipartisan legislation voted into law the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (Act). This act provided changes to the prior Employee Retention Credit (ERC) expanding the coverage period and lowering qualification requirements. Many businesses who were previously ineligible for this assistance are now able to apply for it retroactively.

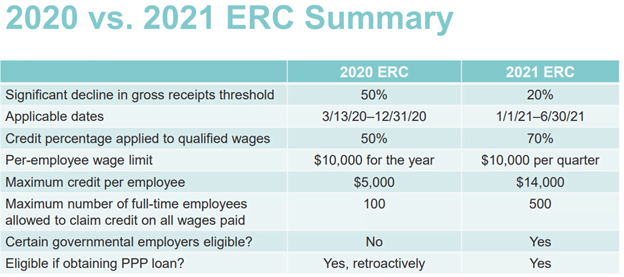

The ERC is a refundable tax credit against the employer’s share of Social Security Tax to offset certain business losses as a result of the Pandemic and to provide support for employers to retain employees. The requirements and calculations of the ERC are different for 2020 and 2021. This credit is a great opportunity for company savings which makes it worth reviewing your eligibility. Below, we compare the eligibility requirements and the main highlights of the ERC for 2020 and 2021.

Overview of ERC for 2020:

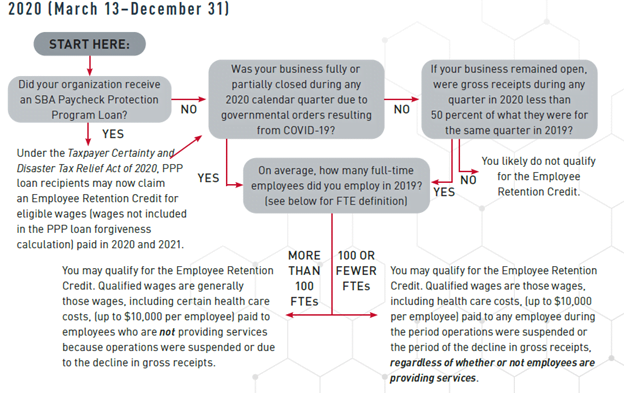

The flowchart below will help determine if you are eligible to apply for ERC for 2020. If you do not qualify for the 2020 ERC, proceed to the 2021 flowchart as you may be eligible for it with these new changes.

The main highlights for 2020 applications and calculations are as follows:

- Recipients of the 2020 Paycheck Protection Program (PPP) loan are now eligible to apply for the ERC. Although only wages not included in the PPP forgiveness calculations are eligible for the ERC.

- Businesses must have suffered a 50% decrease in gross receipts in any quarter of 2020 when compared to that same quarter in 2019.

- The coverage period is from March 13, 2020 to December 31, 2020.

- The maximum credit refund per employee is $5,000 for the year (50% of qualified wages up to $10,000)

- Qualified health care expenses can be considered as qualified wages.

Overview of updates to the ERC for 2021

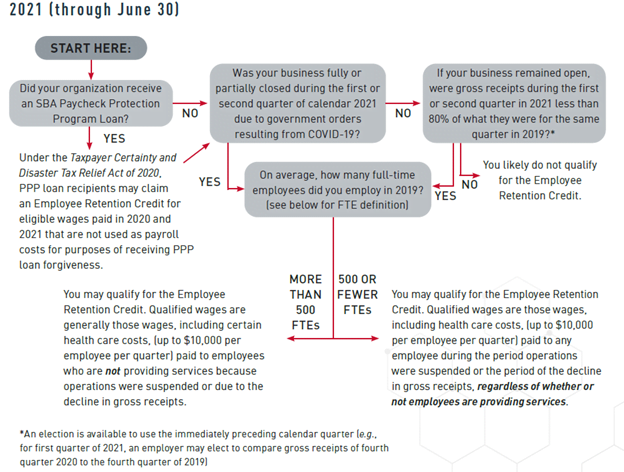

The flowchart below will help determine if you are eligible to apply for ERC for 2021.

The main highlights for 2021 applications and calculations are as follows:

- Recipients of the PPP loan (2020 and 2021) are eligible to apply for the ERC. Still no double dipping on wages.

- Must have suffered a 20% decrease in gross receipts in any quarter of 2020 when compared to that same quarter in 2019.

- The coverage period is from January 1, 2021 to June 30, 2021.

- The maximum credit refund per employee is $7,000 per quarter (70% of qualified wages up to $10,000). This means a max of $14,000 for 2021 as the credit is only approved for the first two quarters of the year.

- Governmental employers are eligible to apply for the 2021 ERC.

Key Term definitions

Full-Time employees (FTE) are defined as employees who work at least 30hrs/week or 130hrs/month.

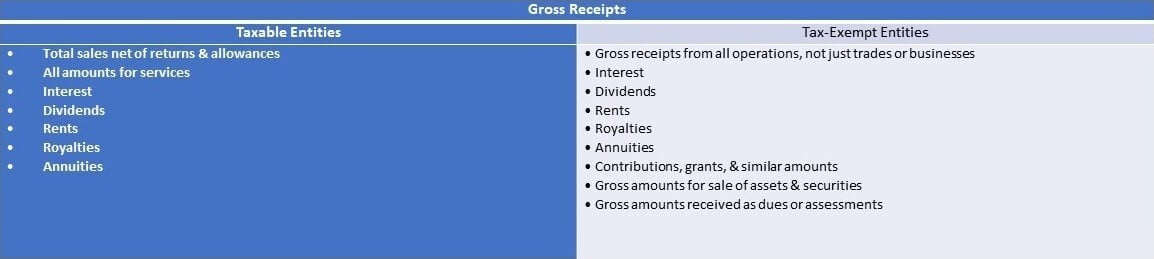

Gross receipts are on a cash basis and should include revenue from the following sources:

Applicants of the PP2 are eligible to use 40% of the loans towards non-salary expenses. Recipients of the PPP2 loan, who also qualified for the ERC, should maximize on these two programs by using the non-salary expenses in their calculation for the PPP2 loan forgiveness. This will leave out wages that can be used to claim ERC since the same wages cannot be used towards PPP loans and ERC.

The deadline for the application for the PPP loan has been extended to May 31, 2020. If you have not yet applied and are eligible, take action now before the new deadline.

If you’re interested in applying for the Employee Retention Credit, we can help. Insource provides support for applying for the PPP loans, the application of PPP loan forgiveness, and Employee Retention Credits.

For more information, email us at insource@insourceservices.com, or call (781) 235-1490.

Related Insights

June is Men’s Mental Health Month: Why It Ma...

Jun 23rd 2025Read More

AI in Action: Elevating Staff Performance Through ...

Jun 10th 2025Read More

Celebrating Pride Month: Embracing Diversity and I...

Jun 9th 2025Read More